With current low capitalization rates in the Canadian real estate market, many Canadians are looking south of the border to the United States for higher returns on their real estate investment. While the US real estate market potentially offers opportunities for growth, there are numerous tax traps for the unwary Canadian investor.

Today, we are exploring the increasingly popular Section 1031 rollover, as a means for Canadian investors to defer gains upon the sale of certain real estate investments in the US.

Background

Section 1031 gets its name from a section of the Internal Revenue Code which is the US equivalent of the Canadian Income Tax Act. A Section 1031 exchange allows an investor in the US real estate market to defer the gain on the sale of a property by allowing the seller to identify and purchase alternative real estate property with the proceeds of the initial sale.

The rules governing a Section 1031 rollover are specific in terms of time limits for the sale and purchase as well as the required use of a third-party Qualified Intermediary to facilitate the retention of funds between the sale and purchase transactions.

Who is the Investor?

If the entity holding the Canadian’s investment is a US corporation or an entity which “flows through” to a “C” corporation such as a partnership or LLC, the Section 1031 rollover is an excellent vehicle for deferring tax.

For Canadian investors such as Canadian individual residents or Canadian corporations, a Section 1031 rollover for real estate held for investment may not work, as Canadian rollover rules only apply to business properties. Investment and rental properties do not qualify for rollover treatment. In addition, the tax-free rollover rules for business properties have different time limitations, which would have to be reconciled with the US time limitations.

Effect of the Different Rollover Rules

The difference in rules can result in double taxation on the deferred gain on the property. As a gain is recognized for Canadian purposes, the Canadian investor will still owe Canadian tax on the sale, even if no US tax is due.

Upon the subsequent sale of the replacement property years later, tax will be due in the US on the gain, on the subsequent sale, plus the deferred gain will also be taxed. In the likely event that the US tax on the subsequent sale is higher, there is no foreign tax credit available from the earlier sale to reduce the second tax event.

Example

Consider the following example. Assume no depreciation or depreciation recapture and no foreign exchange fluctuations.

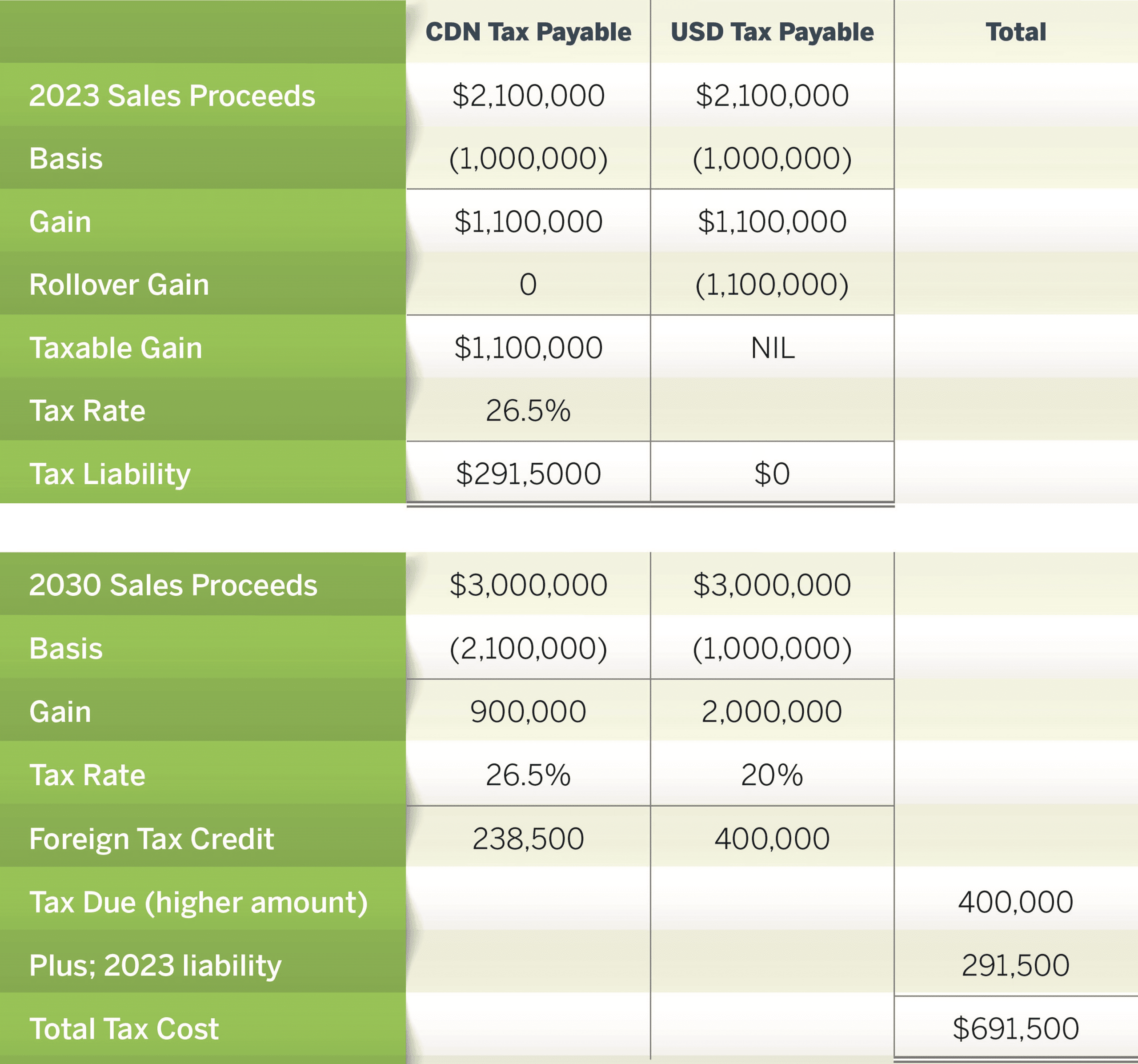

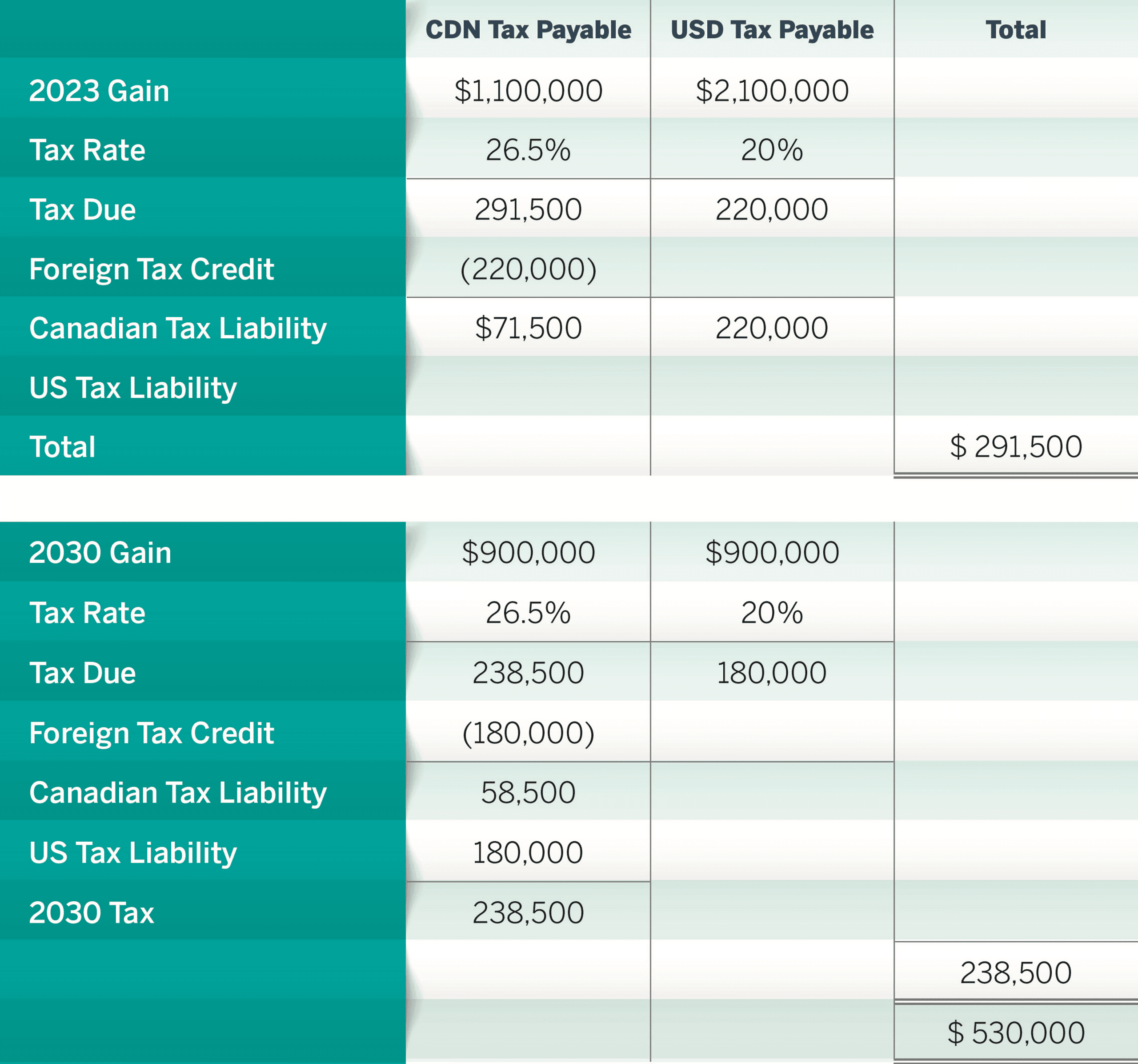

David Pedant, a Canadian resident, purchases a property in Florida in 2009 for USD $1M. The property is sold in 2023 for USD $2.1M. He rolls over the property pursuant to Section 1031 for another USD $2.1 million property in Florida which is sold in 2030 for $3 million of net proceeds.

Calculation with the Section 1031 Rollover (assumes constant USD)

Therefore, on a cumulative gain of $2 million, the effective tax rate exceeds 34.5% under the Section 1031 rollover.

Calculation Without the Section 1031 Rollover

The foregoing example makes certain assumptions about the future of tax rates and foreign currency which cannot be predicted with any degree of accuracy. Regardless, it is evident that the 34.5% cumulative effective tax rate for a Section 1031 rollover under these circumstances is higher than the non-rollover rate of 26.5%.

If you have questions, contact Zeifmans Partner, Stanley Abraham directly at 647. 256.7551 or SA@zeifmans.ca.