In an effort to reduce Canadians’ tax burden during the holiday season, the Federal government announced on Thursday that the majority of expenses will be temporarily free from GST/HST from ...

Reducing your Tax Burden: A Guide to Interest Expense Deductions

If you’re borrowing funds to support business growth and or investment growth, you may be eligible to deduct interest on your business or property income under the Income Tax Act. ...

What does the Capital Gains Inclusion Rate Increase Look Like for You?

This year’s Federal budget marked the first increase to the Capital Gains inclusion rate since 2000, an announcement that many criticized as having significant consequences on both high income and ...

Understanding the CRA’s 2024 Trust and Reporting Updates: Implications and Context

Earlier this year, the Canada Revenue Agency (CRA) announced significant changes to trust reporting rules that introduced new filing obligations for many express trusts, including bare trusts. These new requirements ...

Navigating the Evolving Tax Landscape: Key Changes and Challenges for Businesses

This year has seen significant shifts in tax regulations, making it a particularly volatile period for businesses. Three major tax changes have surfaced in recent years: The Canada Revenue Agency ...

How will Canada’s Capital Gains Increase Affects those with Investments?

The Canadian government’s plan to increase Canada’s capital gains inclusion rate, introduced in the 2024 Federal Budget, has caused growing concern from taxpayers as many consider selling cottages and investments ...

Mastering Taxes: 5 Essential Tips for Small Businesses in Canada

Small businesses are the lifeblood of the Canadian economy, employing nearly 8.5 million Canadians annually. These entrepreneurs are the driving force behind innovation and economic growth in the country. However, ...

Zeifmans recognized as a Top 10 Accounting Services Provider in Canada!

We are pleased to announce that Zeifmans LLP was featured in Business Management Review Magazine’s 2023 Top 10 Accounting Services Providers in Canada! This acknowledgement recognizes Zeifmans’ track record of ...

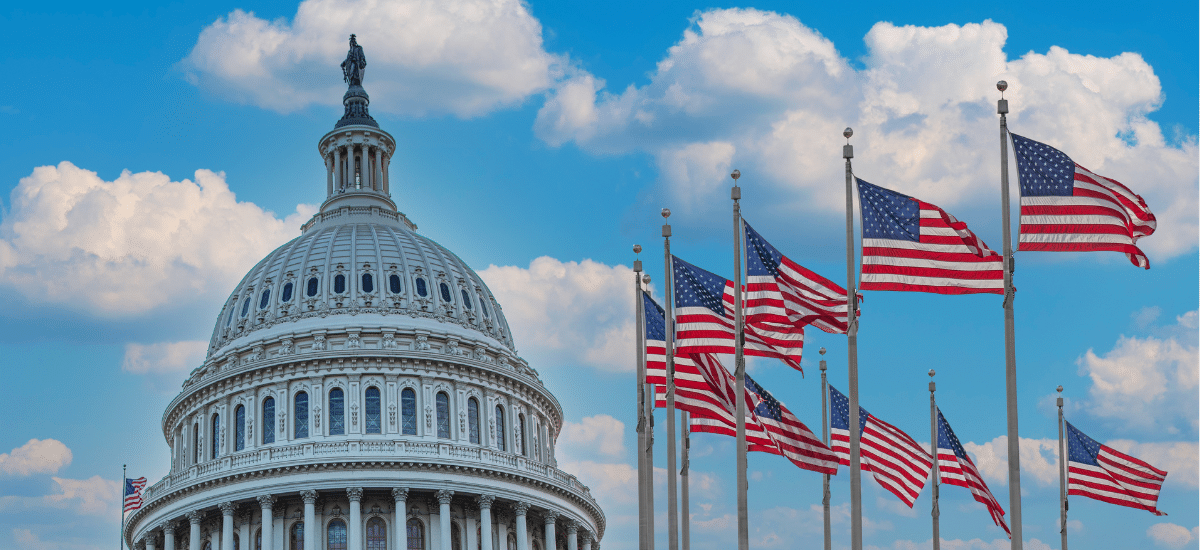

Proposed legislation introduced to reform cannabis taxation in the US

On July 14, 2021, Senate Majority Leader Chuck Schumer released a discussion draft of a detailed cannabis reform bill which, if enacted, would restore the deductibility of all expenses related ...